Quotable Quote

“And when they seek

to oppress you

And when they try

to destroy you,

Rise and rise again

and again

Like the Phoenix

from the ashes

Until the lambs

have become lions

and the rule of Darkness

is no more”Maitreya The Friend of All Souls, The Holy Book of Destiny

There are umpteen number of jokes/ memes/ tweets/ headlines online about Robinhood traders - the retail millennial investors addicted to the zero commission Robinhood app, who have seemingly outperformed the equity benchmarks, wall street veterans and the power of rational thought. Even the financial media is turning this into an us vs them narrative between wall street and the retail investors.

To be fair, one of the main reasons this story about the invincible-for-now but soon-to-face-their-maker has legs is because the leveraged investing community - asset managers & hedge funds - likes to believe that its focus on fundamentals, macroeconomics or some other uber-intellectual metric and the sheer sizing of their trades means that the market owes them money, respect and a whole lot of self worth. That indeed is a broad stroke of brush but having been part of this community for a very long time, I can vouch that the majority fit the profile. And as unprecedented as the recent market volatility has been, the retail investors have been declared as the number one potential enemy with their buy-on-dips mentality keeping even the bankrupt companies afloat and bubbly.

As for Robinhood - the company which in its own words, is

[..] a company that leverages technology to encourage everyone to participate in our financial system

has a learning page for investors that starts off with this article:

¯\_(ツ)_/¯

Well this is not a dissing post on Robinhood. And nope, not even on the Wall street trading community. Allow me a couple more minutes of your time.

Every so often, I get a mobile notification from one of the “neo” wealth management apps occupying real estate on my phone (and am guilty of having one too many) advising to switch from the existing portfolio of Stocks/ Mutual Funds into ETFs or simply to take advantage of this financial engineering marvel. And it makes me twitch a bit. Don’t get me wrong. If not for the ETFs, it wouldn’t have been easy for a retail participant to invest, for example, in the ever-so-performing “lower for longer” interest rates trade of the last few years.

Similarly, for a foreigner to access the tech stocks listed in the US stock market, one would have to jump through multiple operational hoops just to get access to the specific exchange where they are listed, and then some. In fact, it is highly likely that most of your portfolios have at some point felt the warm embrace of an SPY, QQQ, VIX, GLD or their distant cousins.

My main gripe with the ETF evangelists is that the messaging deployed to sell the underlying ETFs is deceptively attractive and mostly incomplete. There is no reference to Creation/ Redemption of ETF shares, discount/premium to Net Asset Value and tracking error. Even the educational material around ETFs is carefully structured so as to highlight just two points - how it doesn’t have the complete downsides of owning a single stock & how operationally cumbersome it will be for an individual investor to replicate the investment process of an ETF on their own.

This post comes from a very personal experience to delve a little deeper into how ETFs work, and why/ when they don’t. With that context, lets begin.

Introduced around 1989, Exchange Traded Funds (ETFs) picked up steam along with a lot of media attention in the early 2000s and the broad pitch since then has unequivocally been that of a low-cost investment vehicle to invest in any asset class or theme - as weird as that may be (SLIM, The Obesity ETF, I am looking at you). At the last count, there are over 6,970 ETFs available globally and while that doesn’t make it any easier to choose the best ones for your portfolio, there is one thing that ETFs seem to have done exceedingly well - solve for the problem of access.

As the name would suggest ETFs are exchange traded units which are structured as a managed fund. Depending on the mandate, these can hold Stocks, Bonds, Commodities, Currencies, Futures etc or try to replicate an index and be passively or actively managed. Unlike a mutual fund, they are actively traded on an exchange, and hence can change hands easily and are an effective way to express views on different time-frames. But like any other share, it’s still a claim on a proportion of the assets in a pool of investments.

The well highlighted pros of ETF investing are:

Diversification — When you invest in an ETF you own a piece of a pool of assets

Accessibility — ETFs allow people with lesser quantum of money to access the same investments as those with higher investable income (think owning amazon fractionally and not having to pay 2400$ to own one single share). They also give access to international investments that can otherwise be difficult (think investment into companies listed in Korea, Singapore, Indonesia but not having to go through the hassle of opening an investment account in any of these places)

Lower fees — ETFs typically have lower expense ratios than mutual funds

Transparency — tradeable shares, you get to see the price on an exchange everyday. Unlike a mutual fund, where any buy/sell transactions happen at a NAV price calculated once a day

Liquidity — because they’re traded on an exchange, the ETF shares can exchange hands

However, there is another reason which adds to the low fees of an ETF, and that is lower frequency of taxable events like buying or selling. This introduces the very unique process of Creating & Redeeming an ETF and introduction of a third entity (APs or Authorized Participant) between the investor and the ETF.

Authorized participants are responsible for acquiring the securities that the ETF wants to hold. If that is the S&P 500 index, they will purchase all its constituents in the same weight and deliver them to the sponsor. In return, authorized participants receive a block of equally valued shares called a creation unit. Issuers can use the services of one or more authorized participants for a fund. Large and active funds tend to have a greater number of authorized participants.

If you are left wondering who these APs are - they are the usual suspects; the likes of Bank of America, JPMorgan, Goldman Sachs, and Morgan Stanley, among others. And they are the ones dealing with the ETF sponsor (Blackrock, Vanguard, PIMCO). They do not receive compensation from the ETF and have no legal obligation to redeem or create the ETF's shares.

By definition, Creation/ Redemption process of ETF is the Primary Market, and the act of buying/ selling ETFs on an exchange (as all of us retail investors do) is the secondary market. The authorized participants are compensated through activity in the secondary market or service fees collected from clients wanting to execute primary trades. It is important to note here that the APs are not the same as Market Makers (MM). The firms playing AP and MM role might be the same i.e. JP Morgan can both be an AP and a MM for an ETF. But that’s not a given.

Creations of new shares and redemptions of existing shares are generally initiated by MMs who engage an AP when there is an imbalance of orders to buy or sell ETF shares that cannot be met through the secondary market. Market makers acquire long or short positions in ETF shares through secondary market trading, and may seek to manage these inventories by redeeming shares or creating new ETF shares through or as APs.

Secondary market trading in ETF shares does not require transaction activity in the underlying securities. The secondary market (exchange-traded) trading volume for most ETFs is typically a multiple of the volume of creation / redemption activity. [...] By facilitating demand from buyers and sellers through a transparent, exchange-traded instrument, ETFs may provide incremental exchange liquidity beyond that of the underlying assets

Why is the Creation/ Redemption Process important though?

Because an ETF trades like a stock, its price will fluctuate during the trading day, due to simple supply and demand. If many investors want to buy an ETF, for instance, the ETF’s share price might rise above the value of its underlying securities. When this happens, the AP can jump in to intervene. Recognizing the “overpriced” ETF, the AP might buy up the underlying shares that compose the ETF and then sell ETF shares on the open market. This should help drive the ETF’s share price back toward fair value, while the AP earns a basically risk-free arbitrage profit.

[…] This arbitrage process helps to keep an ETF’s price in line with the value of its underlying portfolio. With multiple APs watching most ETFs, ETF prices typically stay in line with the value of their underlying securities.

Now that the more important stuff is out of the way - Most ETFs have an underlying reference index that they claim to track. Tracking error is simply the difference between the returns of the ETF and its reference index. A high tracking error therefore represents a failure to replicate the reference. If an ETF deploys a selective sampling strategy as against a full replication of reference index, tracking error could be significant. Some of the most liquid equity ETFs (SPY or QQQ for example) tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. However, for an ETF focused on global sovereign bond market, it will be impossible to deploy replication strategy due to the number of securities constituting the reference index, hence forcing them to rely on sampling and introducing a divergence in returns from that of the reference index.

Not to pass any judgement, but a major criticism of ETFs has been that they create a dilemma for an ethical investor: If a majority of investors hold ETFs and do not trade the individual stocks that sit inside of them, then price discovery for the individual securities that constitute and index may be less efficient. In the worst case, if everybody owns just ETFs, then nobody is left to price the component stocks and thus the efficiency of the market breaks.

Well, there is more than $5 trillion invested in ETFs globally, and ETFs account for almost a quarter of daily trading activity in US stock markets. Thus, its not just a financial literacy issue but also a financially savvy decision to understand the pros and cons before getting yourself all to cozy with ETFs.

With that, am introducing a new short section below, Now You Know, where I will try to change the flavour from the usual narrative of the post and (hopefully!) introduce you to something you might not be familiar to. A TIL of sorts, if you will.

Now You Know

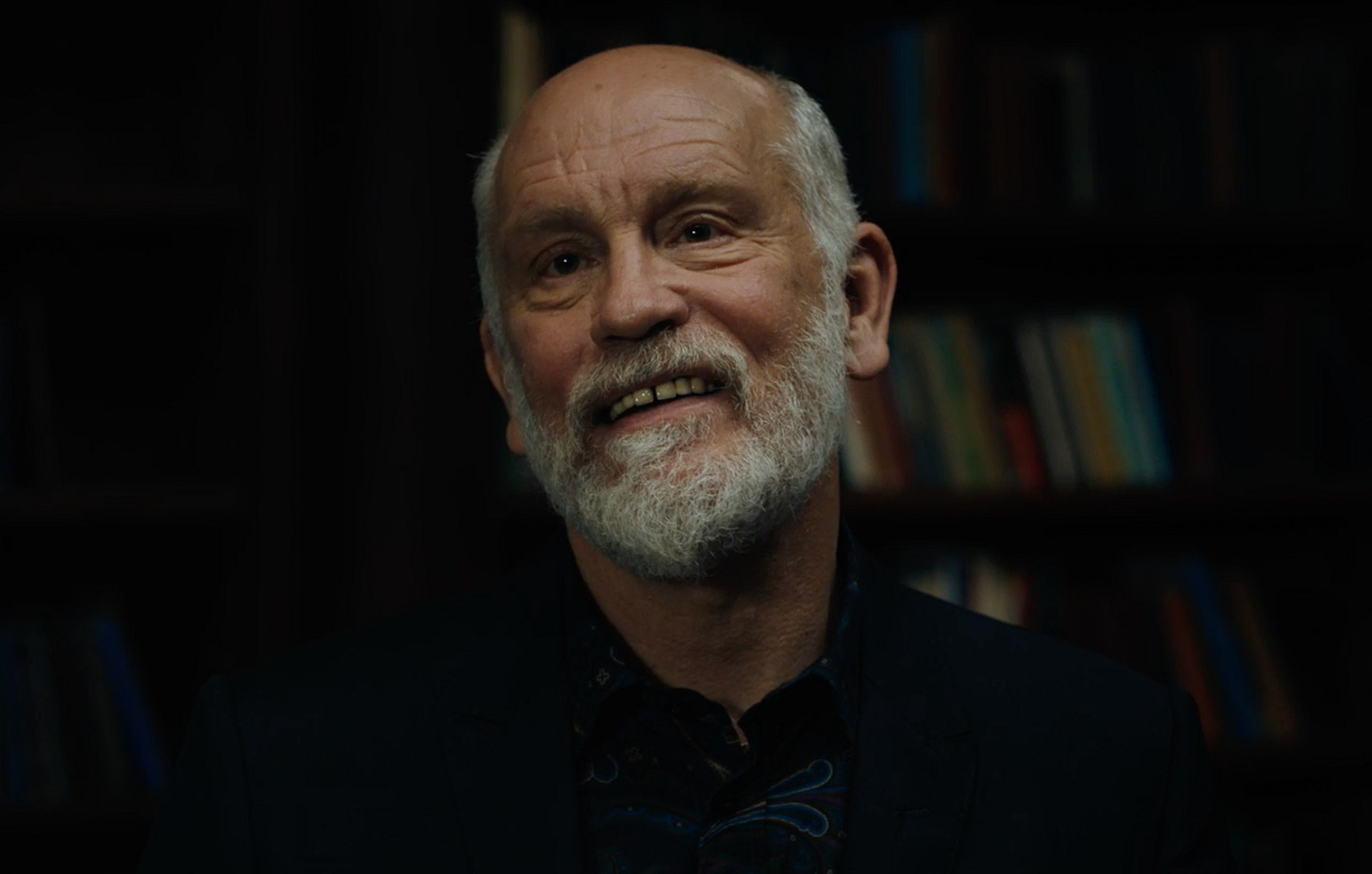

John Malkovich, yes the man who played himself in a movie, and whose accent has been a source of intrigue to anyone who has ever seen him in a movie, is also a fashion designer. Not the kind who slap their name on whatever brand bids highest, but the one who actually designs the clothes. Yep.

Occam’s Earworm

Thanks for reading and being a subscriber. Please shoot all brickbats and suggestions my way on twitter. And if you do like it, you know what to do.